PRIVATE WEALTH WITHOUT BORDERS

Global Real Estate Investing.

Rebuilt For The Modern World.

*Only accepting 10 accredited investors this round...

**This offering is being made under Regulation D. Only available to accredited investors.

What If Robinhood, Blackstone, and CitizenM Had a Baby?

Meet Global Mogul...

A Fintech Powerhouse Redefining

Global Real Estate Investing.

*Only accepting 10 accredited investors this round...

Click "Get The Free Report" to get started and to review the offering documents.

**This offering is being made under Regulation S and Reg D. Meaning only available for anyone over the age of 18 and resides outside of the USA or someone who lives in the USA and is an accredited investor.

Now, for the first time, we’re opening access to a limited group of accredited investors.

Watch the video below...

Global Mogul is Real Estate and Fintech combined to create a powerful startup poised to revolutionize the real estate industry and this is your opportunity to own the entire Global Mogul ecosystem; at the ground floor.

You're not just investing in a company. You’re becoming a founding equity partner in a bold, three-phase juggernaut built to reshape global real estate and unlock generational wealth.

Here’s what you’ll own:

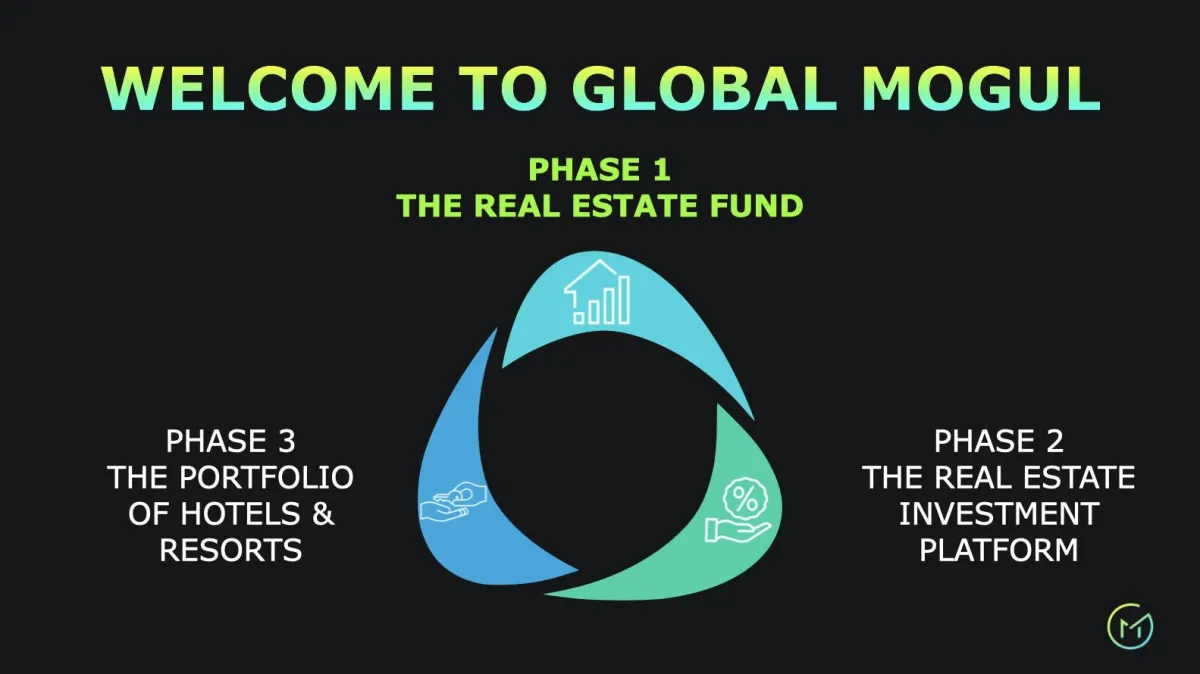

Phase 1: A cash-flowing real estate debt fund, starting in Latin America with secured developer loans offering up to 15% APY.

Phase 2: A Robinhood-style investing platform where investors can buy, sell, and build global real estate portfolios as easily as stocks; powered by SEC-regulated fractional ownership featuring only 21 day holding periods.

Phase 3: A branded chain of luxury hotels, residences, and lifestyle hubs that blends the freedom of Airbnb, the service of a 5-star hotel, the connectivity of WeWork, and the exclusivity of Soho House.

ACCESS UNLOCKED

NOW YOU HAVE THE POWER!

The best real estate deals never hit the market. They move through private networks, family offices, and institutions.

Retail investors get the leftovers.

We built the system to change that.

THE

BIG IDEA

Global Mogul is building a revolutionary, borderless platform where investors can earn high-yield passive income from real estate, own fractional shares of luxury properties around the world, and access exclusive branded lifestyle destinations; just like owning stock in a global luxury empire.

It’s not a fund. It’s not a REIT. It's not an SPV. It's not a Syndication... It’s a global wealth engine that combines fintech, real estate, and lifestyle into one unified investment experience.

We're giving investors the power to:

Grow wealth through secured, high-return developer loans

Own real estate like stocks;fractional, trade-able, international

Live anywhere in the world with luxury access and investor perks

BE THE BANK

WEALTH IS BUILT BY CONTROLLING THE CAPITAL.

The people who win consistently sit at the top of the capital stack.

They get paid first. They choose the terms. They control the downside.

So we built a platform where investors become the bank.

Now, for the first time, we’re opening access to a limited group of accredited investors.

Watch the video below...

Global Mogul is Real Estate and Fintech combined to create a powerful startup poised to revolutionize the real estate industry and this is your opportunity to own the entire Global Mogul ecosystem; at the ground floor.

Here’s what you’ll own:

Phase 1: A cash-flowing real estate debt fund, starting in Latin America with secured developer loans offering up to 15% APY.

Phase 2: A Robinhood-style investing platform where investors can buy, sell, and build global real estate portfolios as easily as stocks; powered by SEC-regulated fractional ownership featuring only 21 day holding periods.

Phase 3: A branded chain of private residence clubs that blend the freedom of Airbnb, the service of a 5-star hotel, the connectivity of WeWork, and the exclusivity of Soho House.

ONE PLATFORM ENDLESS POSSIBILITIES

This isn’t just a fund. Or a hotel brand. Or an investment platform.

Global Mogul is a revolutionary wealth engine - where all three converge into one unstoppable ecosystem.

For decades, elite global real estate was off-limits. Hidden behind private networks, complex structures, and minimums only the ultra-wealthy could afford.

We’re changing that; permanently. Global Mogul gives you direct access to the same high-yield opportunities the top 1% have quietly capitalized on for generations:

REAL ESTATE INVESTING REINVENTED

Global Scale & Luxury Focus: Most platforms stay local. We go international; investing in high-end hospitality properties across booming global markets.

Professionally Managed: Who needs the hassles of airbnb ownership when you can get passive income from a luxury unit with world-class amenities like gyms, rooftop pools, restaurants, co-work and meeting rooms and much more; all professionally managed for you!

Fractional Ownership with Liquidity: Forget 5- to 10-year lockups. With our sponsorship model, you get a luxury suite with easy exit after 3 years with only a 60 day notice. Plus, with our Reg A fund (COMING SOON), investors can access liquidity options after just 21 days.

Built-In Exit Strategy: We're not just collecting rent. We’re building a scalable hotel brand with the goal of a major buyout by an international chain; giving you a real exit and potential windfall.

SEC-Regulated for Peace of Mind: Unlike offshore-only platforms, Global Mogul is fully U.S.-regulated and SEC-compliant, giving you trust, transparency, and protection.

PHASE 1

Build The High-Yield

Real Estate Fund

PHASE 2

Unlock Fractional

Real Estate Ownership

PHASE 3

Enjoy Branded

Lifestyle Destinations

*Only accepting 10 accredited investors this round...

THE REAL ESTATE FUND

AN INSTITUTIONAL FUND FOR THE MODERN INVESTOR.

We deploy capital into secured real estate loans in high growth global markets.

Shorter timelines. Real collateral. Priority position.

Developers need capital more than we need deals. That leverage creates predictable income.

Result Focus... Income first. Risk reduced. Control increased.

We're launching a true institutional-grade fund built for high-net-worth individuals, financial institutions, family offices, and private funds. Watch the video below...

PHASE 1 -

THE REAL ESTATE FUND

Who never loses in a deal?

The bank… that’s why Global Mogul begins as a real estate debt and equity fund that finances developers, hotel operators, and expats across Latin America. We provide secured loans backed by high-value collateral and share from 10%-30% APY with our investors.

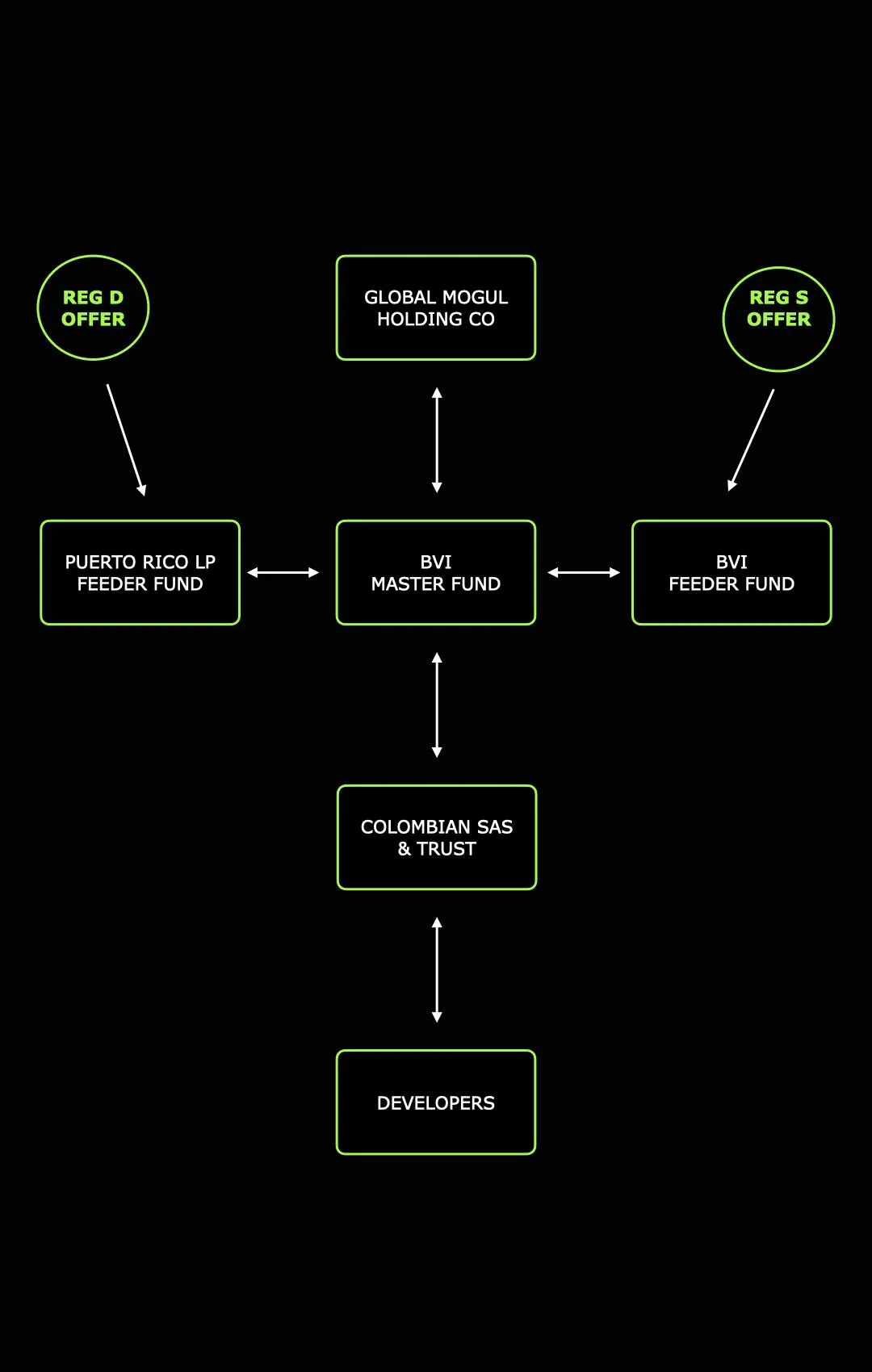

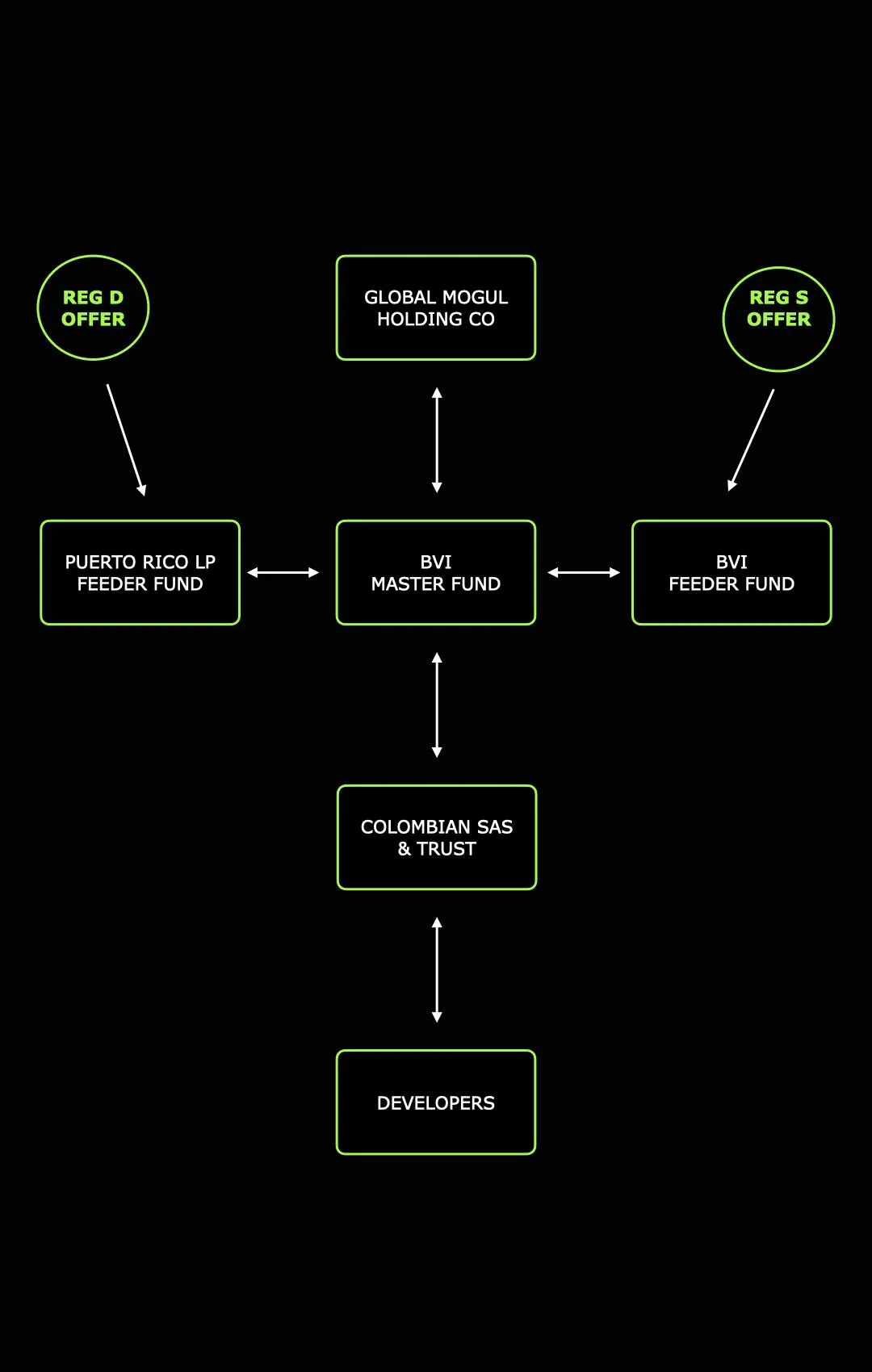

Global Mogul is building a multi-jurisdictional fund architecture designed for serious scale. Our structure includes:

A Puerto Rico feeder fund for US, Canadian, and UK investors

A BVI feeder fund for international investors

A centralized BVI master fund and trust, which deploys capital into Colombia through our local SAS entity

We're launching a true institutional-grade fund built for high-net-worth individuals, financial institutions, family offices, and private funds. Watch the video below...

THE INVESTMENT PLATFORM

FROM LENDER TO OWNER WITHOUT THE HEADACHES.

Invest fractionally in our large income producing assets...

Introducing Private Residence Clubs. Now you can live, work and play... And you own it all!

Get the free report to find out about our Robinhood-style investing platform where investors can buy, sell, and hold global real estate portfolios as easily as stocks.

Only accepting 10 accredited investors this round...

PHASE 2 -

THE INVESTMENT PLATFORM

Next, we're building the Robinhood of global real estate; a fintech platform that allows investors to buy, sell, and hold fractional shares of real estate, just like stocks.

With the power of SEC-regulated Fractional Reg A+ offerings and our partnership with Dalmore Group, investors will be able to build diversified real estate portfolios with ease… from beachfront condos to branded resort shares.

Get the free report to find out about our Robinhood-style investing platform where investors can buy, sell, and hold global real estate portfolios as easily as stocks.

Only accepting 10 accredited investors this round...

THE PRIVATE RESIDENCE CLUBS

YOUR INVESTMENT BECOMES YOUR DREAM AND YOUR LIFESTYLE.

Members gain access to a global network of luxury residences.

Hotel level service. Prime locations. Member only access.

You can stay in what you own. Earn while you live. This is how modern wealth moves.

Get the free report to find out more about our Private Residence Clubs.

*Only accepting 10 accredited investors this round...

PHASE 3 -

THE BRANDED HOSPITALITY CHAIN

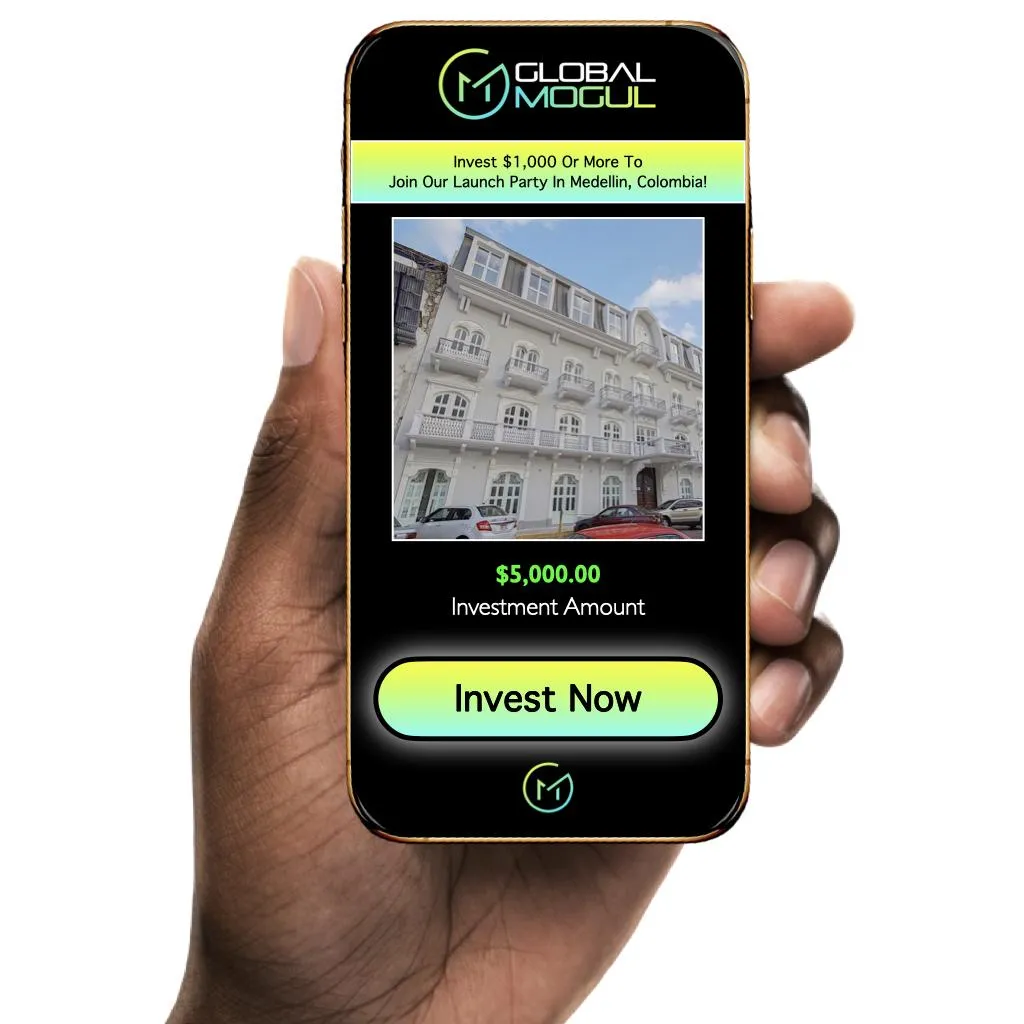

And finally, Global Mogul is developing a chain of luxury lifestyle hotels and residences that blend the Airbnb experience, the 5-star amenities of a hotel, the co-working culture of WeWork, and the global exclusivity of Soho House.

Studios, 1-bedrooms, 2-bedrooms, and penthouses. Rooftop pools. Spas. Wellness. Gourmet restaurants. Wine bars. Fashion boutiques. Co-working lounges and more…

This is CitizenM meets Airbnb; but fully investable.

Get the free report to find out more about our branded chain of luxury hotels, residences, and lifestyle hubs that blends Airbnbs and Hotels.

*Only accepting 10 accredited investors this round...

WHY LATIN AMERICA? WHY NOW?

THIS IS WHERE THE NEXT BLUE OCEAN LIVES

Land rich markets. Capital constrained developers. Exploding tourism. Early entry positioning

We move before institutions arrive. That is where outsized returns are created.

Welcome to Latin America, the ultimate investor’s paradise, where opportunity meets lifestyle, and smart investors are cashing in.

Watch the video below...

WHY LATIN AMERICA? WHY NOW?

Latin America is undergoing a massive real estate boom driven by:

Exploding tourism and digital nomad migration

Undervalued beachfront and luxury city real estate

New residency-by-investment laws

A growing middle class with luxury tastes

Global investors looking for yield, lifestyle, and citizenship diversification

This is your first-mover advantage. We're already deploying capital and generating revenue from developer loans. Your equity helps us scale our fund, launch the tech platform, and acquire flagship properties.

Welcome to Latin America, the ultimate investor’s paradise, where opportunity meets lifestyle, and smart investors are cashing in.

Watch the video below...

THE PRIVATE NETWORK

YOUR NET WORTH IS YOUR NETWORK.

This is a curated group of investors, founders, and operators.

No noise. No tourists. Just people building real wealth.

Private introductions. Capital partnerships. Deal flow access.

Get the free report to get access to our entire suite of investor documents!

*Only accepting 10 accredited investors this round...

THE GLOBAL MOGUL INVESTMENT THESIS

The future of wealth is borderless and Global Mogul is built on the conviction that the next wave of generational wealth will not be created in New York, London, or Los Angeles; but in places like Medellín, Quito, Panama City, and beyond.

We are capitalizing on the $500+ billion Latin American real estate boom, global migration trends, and the inefficiencies of institutional capital in emerging markets to deliver high-yield, collateralized cash flow, early-stage equity upside, and lifestyle-access investing… all under one global investment platform.

This isn’t just real estate. It’s a financial revolution.

We created a special report about our investment thesis only available to waitlist subscribers. Click the button below to get access!

*Only accepting 10 accredited investors this round...

PRIVATE EVENTS AND PRIVILEGE

DEALS ARE BUILT IN PRIVATE ROOMS AND YOUR IN THEM NOW.

Invite only dinners. Investor retreats

Asset launches. Global gatherings

Trust is built in person. So is opportunity. Welcome to the big leagues.

THE CORE COMPETITIVE ADVANTAGE

Latin America is undergoing a massive real estate boom driven by:

Institutional-Grade Infrastructure - This makes us institution-ready; yet available to individual accredited investors right now.

First-Mover Access to Undervalued, High-Growth Markets

While institutional capital is still asleep, we’re capitalizing on moving in hard and fast.

Asymmetrical Risk. Asymmetrical Reward. We combine: Secured developer loans (high yield, low risk). Early equity in a global platform (high upside). Access to hospitality assets (real-world utility + lifestyle perks). Finally, multiple exit strategies that include buyout and especially IPO (both huge upside with 50-100x or more potential)

Borderless Wealth Creation

We don’t just offer returns. We offer residency, lifestyle, freedom and a plethora of investment opportunities that would make any big institution jealous.

THE BIG IDEA

Global Mogul is the first investment platform where you can earn like a bank, invest like a VC, and live like a global citizen.

We are democratizing access to institutional-quality global real estate; while building a brand that offers not just profit, but purpose.

Real Assets. Real Cash Flow. Real Vision.

At Global Mogul, we don’t sell promises. We deliver real returns, backed by real estate, with real collateral.

By early 2026, we will launch a high-yield debt fund that finances luxury developments across Latin America; secured by tangible real estate at up to 200% loan-to-value ratios. Our loans generate predictable, passive cash flow, and our investors are earning 10%-30% APY; even as traditional markets remain volatile.

DEAL TERMS

Minimum Investment: $25,000

Total Raise: $1 million

Valuation: 4 million Post

Regulation Type: Reg D

Offering Details: SAFE

Holding Period: 1 Year

Funding Round: Pre-Seed

Conversion Terms: Reg CF Round

Our Strategic Roadmap:

Milestones That Drive Momentum

*Only accepting 10 accredited investors this round...

THE INVESTMENT OPPORTUNITY

We're raising $1 million at a $3 million valuation under Regulation D, available only to accredited investors.

Your investment includes:

Your investment secures future equity in Global Mogul through a SAFE; giving you early ownership rights in the holding company.

Discounts in our SAFE from 20%-50%; depending on investment size.

Access to passive income from high-yield developer loans (targeting 10%–15% APY)

First access to priority shares in our Reg A+ fractional ownership offerings via our groundbreaking Robinhood-like investment platform.

Investment into the holding company gets you automatically invested into every branded hotel/residence properties.

Real estate exposure across Colombia, Mexico, and Panama now with more countries coming soon.

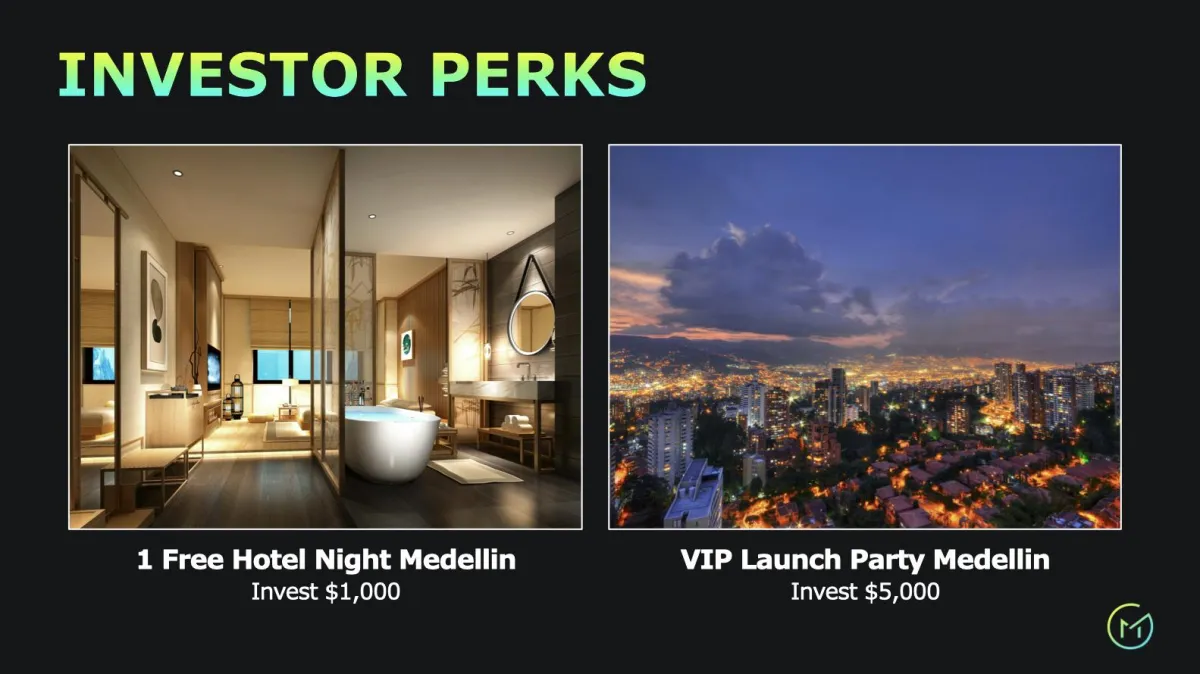

Lifestyle benefits such as free stays, discounts, and members-only perks.

Access to Latin American and especially Colombian residency by investment.

KEY DEAL TERMS

Minimum Investment: $25,000

Total Raise: $1 million

Valuation: 4 million

Regulation Type: Reg D

Offering Details: SAFE

Holding Period: 1 Year

Funding Round: Pre-Seed

Conversion Terms: Reg CF Round

Tax Efficient Structure: Via integration of BVI company entity

Superior Roadmap: Reg D, Reg CF, Reg A, Fractional Ownership Platform, Airbnb Hotels

Equity Exit Strategy: IPO or strategic acquisition within 10 years

Our Strategic Roadmap:

Milestones That Drive Momentum

*Only accepting 10 accredited investors this round...

OWNER THE ENTIRE ECOSYSTEM

OUR MEMBERS DON'T JUST INVEST, THEY OWN THE ENTIRE SYSTEM.

Early members receive access to SAFE offerings.

Valuation discounts. Priority allocations. Long term platform upside.

You earn income today... And equity in the machine tomorrow.

WHO IS THIS FOR?

THIS IS NOT FOR EVERYONE. ONLY THE GLOBAL MOGULS... LIKE YOU!

If you want small, safe, and slow. This is not for you.

If you want access. If you want leverage. If you want to invest like it is 2026, not 1986.

You're in the right place.

WHO IS THIS INVESTMENT FOR?

We serve those who think bigger, live freer, and build with intention.

Entrepreneurs and high-income business owners seeking legal tax optimization, global assets, and lifestyle flexibility

Accredited investors looking for secured, passive returns backed by hard real estate assets

Real estate professionals and developers seeking strategic partnerships, capital, and powerful deal structures

Founders and wealth builders who want to reduce taxable income, gain international exposure, and increase liquidity

Visionaries pursuing second residencies, generational wealth, and legacy planning

Global citizens who want not just money, but meaning; through real estate, travel, culture, and connection

WHY GLOBAL MOGUL IS IRRESISTIBLE TO VISIONARIES

Equity ownership into the holding company - in a high-growth international investment platform with built-in scale

Equity ownership of our institutional-grade fund - Up to 15% APY passive, secured income backed by 100%–200% real estate collateral

Equity ownership in our Robinhood-style real estate investing platform - Real estate + fintech = explosive upside. This is your chance to get in early on a future IPO juggernaut

Equity ownership in every branded hotel, residence, and commercial property - Most investors get one door. You get the whole portfolio. This isn’t ordinary... and neither are you

Real tax advantages - via Puerto Rico and BVI structuring, investor residency programs, and property-based deductions

Holding Period: 1 Year

Funding Round: Pre-Seed

*Only accepting 10 accredited investors this round...

OUR INVITATION TO YOU

THE WEALTHY DON'T CHASE DEALS... THEY BUILD THE SYSTEMS.

This is not another investment. This is not another platform.

This is a private investing distribution system.

Capital flows in. Assets scale. Data compounds... And our members win together.

Get the free report to get access to our entire suite of investor documents!

*Only accepting 10 accredited investors this round...

HOW GLOBAL MOGUL IS CHANGING THE WORLD

We’re taking the elite financial structures once reserved for billion-dollar family offices; and democratizing them.

Global Mogul is the bridge between undervalued, high-growth markets in Latin America and the global investor class hungry for yield, security, and mobility.

We’re unlocking access to:

Institutional-grade fund infrastructure

Global Luxury real estate in emerging destinations

Global lifestyle and residency benefits

Decentralized investing with centralized upside

FULL TRANSPARENCY & COMPLETE ACCESS

Investor Landing Page

Global Mogul Corporate Site

Subscription Agreement

Full White Paper

Full Investor Deck

Full Investment Thesis

Full Proprietary Strategies

Full Video Library

Access to Our Upcoming Webinar

Get the free report to get access to our entire suite of investor documents!

*Only accepting 10 accredited investors this round...

HERE'S WHAT HAPPENS NEXT

Once you join the waitlist, you will receive a special invitation to a private investor call.

On the call, we’ll walk you through:

Our Subscription Agreement

Legal Structure and Fund Architecture

Detailed Roadmap

Full Suite of Investor Perks

How to participate and what ownership unlocks for you

AFTER YOU INVEST

At Global Mogul, we don’t make money off our investors; we build wealth with them. We’re a founder-led, real-asset investment platform with a mission: help you grow passive income, reduce your tax burden, and unlock global freedom.

Here’s what happens when you step into your role as a Global Mogul:

Direct Access to the Founders

Quarterly Mogul Briefings

On-Site Tours + Property Access

Exclusive Investor Perks

Free night stays at our luxury hotels and resorts

VIP access to private parties and launch events

Private member-only areas across Global Mogul properties

Discounted access to our Sanctuary Club membership

Early Invitations to co-invest in future deals before the public

Get the free report to get access to our entire suite of investor documents!

*Only accepting 10 accredited investors this round...

HERE'S WHAT HAPPENS NEXT

After reviewing our documentation and seeing how our model will produce real equity opportunity, your next step is simple:

Once you join the waitlist, you will receive a special invitation to a private investor call.

On the call, we’ll walk you through:

Our Subscription Agreement

Legal Structure and Fund Architecture

Detailed Roadmap

Full Suite of Investor Perks

How to participate and what ownership unlocks for you

This round is limited to a handful of accredited investors.

If you're ready to take control of your wealth and gain early access to the future of global real estate; your seat at the table is waiting.

WHAT HAPPENS AFTER YOU INVEST

At Global Mogul, we don’t make money off our investors; we build wealth with them. We’re a founder-led, real-asset investment platform with a mission: help you grow passive income, reduce your tax burden, and unlock global freedom.

This isn’t just an investment. It’s an invitation to join a movement.

Here’s what happens when you step into your role as a Global Mogul:

Direct Access to the Founders - Every investor gets a personal connection to our leadership team. No bots, no barriers, no ticketing systems. Have a question about fund distributions, new projects, or legal structures? Just call, email, or text; we’re here for you.

Quarterly Mogul Briefings - Each quarter, you’ll join an exclusive investor-only Zoom with our founding team. You’ll get real-time insights into our cash flow, property acquisitions, fund performance, and our hospitality brand rollouts across Latin America. Plus, insider previews of new projects before the public ever hears about them.

On-Site Tours + Property Access - Want to walk the land, see the buildings, and meet the developers? We’ll personally invite you to tour our luxury real estate projects in Colombia, Mexico, and Panama. This isn’t theory; this is boots on the ground, glass in hand, seeing your capital at work.

Exclusive Investor Perks - As a Global Mogul investor, you get more than returns:

Free night stays at our luxury hotels and resorts

VIP access to private parties and launch events

Private member-only areas across Global Mogul properties

Discounted access to our Sanctuary Club membership

Early Invitations to co-invest in future deals before the public

Join the waitlist to get access to our entire suite of investor documents!

*Only accepting 10 accredited investors this round...

Get The Answers

What is Global Mogul?

Global Mogul is a fractional investment platform for global commercial real estate and an international real estate fund that connects investors with high-yield, collateral-backed development loans and exclusive property opportunities in Latin America; primarily Colombia, Mexico, Panama, and soon in Asia.

Who founded Global Mogul?

Global Mogul was founded by JC Vasquez, a capital raising expert with over a decade of experience in securing funding for high-growth ventures, with a passion for creating wealth-building opportunities that are secure, global, and scalable.

What is Global Mogul’s mission?

Our mission is simple: help investors grow and protect their wealth while gaining access to borderless opportunities that build lasting legacies for themselves and their families.

Where is Global Mogul based?

Our corporate structure includes a Delaware C-Corp holding company, a Puerto Rico LP feeder fund, a Colombian SAS, and an upcoming BVI master fund. This structure optimizes tax efficiency, investor protection, and operational flexibility.

What is Global Mogul’s long-term vision?

To become the premier global investment platform for borderless living, combining real estate, fintech, hospitality, and lifestyle into a single ecosystem.

How does Global Mogul differ from other funds?

We combine high-yield returns, collateral protection, lifestyle perks, and global market access — all in a structure that’s built for both wealth growth and wealth preservation.

What is our Big Idea?

Global Mogul exists to connect ambitious investors with the fastest-growing real estate and private investment opportunities in Latin America. We secure high-yield returns by lending to top-tier developers and acquiring premium hospitality and residential assets; all while protecting investor capital with strong collateral. Our model combines private equity discipline, venture-style upside, and the security of hard assets. The big idea is simple: deliver double-digit returns, asset-backed security, and global lifestyle perks in one investment platform.

Why Now?

The window is open, but it will not stay that way. Latin America is entering a historic economic expansion driven by nearshoring, digital adoption, tourism booms, and urban migration. Real estate values are still undervalued compared to global norms, but foreign capital is flowing in at record speed. Those who position themselves now will ride the wave of appreciation and income for the next decade. Waiting means paying more and earning less.

Why Latin America?

* High Growth – GDP growth in key markets like Colombia, Mexico, and Panama outpaces much of the developed world.

* Undervalued Assets – Premium real estate in prime locations is still a fraction of U.S. or European prices.

* Strong Demographics – Young, urbanizing populations fuel housing demand.

* Tourism Surge – Post-pandemic travel is pushing record tourism numbers, especially in luxury segments.

* Pro-Investment Policies – Residency programs, tax incentives, and foreign-investment-friendly laws make entry simple.

What is our 5- and 10-Year Outlook?

Colombia:

* 5 years: Medellín, Cartagena, and coastal zones see sustained price appreciation as tourism and expat inflows increase.

* 10 years: Colombia positions as the “Mediterranean of the Americas,” with mature luxury real estate and stable investor demand.

Mexico:

* 5 years: Nearshoring boom drives industrial and residential growth in cities like Monterrey, Tulum, and Mexico City.

* 10 years: Mexico cements itself as a global manufacturing and tourism powerhouse with significant real estate appreciation.

Panama:

* 5 years: Infrastructure expansion and Canal-related trade growth boost Panama City and coastal property markets.

* 10 years: Panama becomes the Singapore of the Americas — a global logistics and finance hub with prime asset values.

How Our Fund is Different?

1. Asset-Backed Security: Developer loans are fully collateralized (100%–200% of loan value).

2. High-Yield Passive Income: Up to 15% APY distributed quarterly or annually.

3. First-Mover Advantage: We target undervalued, high-growth Latin markets before mainstream capital floods in.

4. Dual Strategy: Lending for predictable returns + equity in premium hospitality assets for long-term upside.

5. Global Lifestyle Perks: Investors gain access to our resorts, residences, and members’ club benefits.

How Our Fund is Structured?

* Global Mogul Holding Co. (Delaware C-Corp) – Oversees global operations and intellectual property.

* Puerto Rico Feeder Fund (LP) – U.S. investor entry point with tax-efficient distributions.

* BVI Master Fund – Centralized investment pool holding Latin American assets and loans.

* Colombian SAS / Local Entities – Hold property titles, register mortgages, and manage operations on the ground.

Why Puerto Rico Feeder Fund?

The Puerto Rico LP allows U.S. investors to participate in Global Mogul with tax-efficient returns under U.S. law, while streamlining compliance and administration. It bridges mainland U.S. capital to offshore growth with minimal friction.

Why BVI Feeder Fund and Master Fund?

The BVI structure offers flexibility, privacy, and global investor access. It allows both U.S. and non-U.S. investors to participate through a neutral jurisdiction while consolidating operations in the master fund for efficiency and scalability.

What Are The Top 10 Reasons to Invest in Global Mogul?

1. Up to 15% APY on secured developer loans.

2. 100%–200% collateral coverage for capital protection.

3. Exposure to booming Latin American real estate before the market peaks.

4. Dual income & growth strategy – lending plus equity in hospitality assets.

5. Global lifestyle perks for investors (stay, use, or rent).

6. Tax-efficient structures for both U.S. and international investors.

7. Experienced management team with deep capital markets and real estate expertise.

8. Diversification across multiple countries and asset types.

9. First-mover advantage in high-growth, undervalued markets.

10. Aligned incentives – we invest alongside our investors.

What is the minimum investment?

The minimum investment is $25,000 USD.

What kind of returns can I expect?

Investors are investing in Global Mogul Holding Co., this is a ground-floor opportunity to make one investment and own a piece of the fund, the fractional investing platform and the hotels, residences and more.

What is a SAFE agreement?

A SAFE (Simple Agreement for Future Equity) is an investment contract that gives investors the right to receive equity in a company in the future, typically when the company raises its next funding round. SAFE investors don’t get shares right away—they convert their investment into equity later, often at a discount or with a valuation cap. It’s a fast, founder-friendly alternative to traditional equity rounds.

What is a SAFE discount and how is it calculated?

A SAFE discount is a percentage reduction in the share price that SAFE investors receive when their investment converts to equity. For example, if the next funding round values shares at $1.00 and the SAFE has a 20% discount, the investor gets shares at $0.80 each. This rewards early investors for taking on more risk before the company’s valuation increases.

What is a pre-seed round?

A pre-seed round is one of the earliest stages of startup fundraising, typically before the business is fully operational. It’s used to fund product development, market research, and initial operations. Investors at this stage; like those in Global Mogul’s early raises... get in at a lower valuation, which means potentially higher returns if the company grows.

What is a Reg D offering?

A Regulation D offering is a type of private placement that allows companies to raise capital from accredited investors without going through the full SEC registration process. Global Mogul uses Reg D to efficiently raise funds while still meeting U.S. securities regulations. It’s only open to accredited investors who meet certain income or net worth requirements.

What is an accredited investor?

Our best advice is to use our third-party verification letterInstead of uploading personal documents, we recommend seeking one of these professionals to review your personal documents and complete this standard template letter:

CPA

Accountant

Lawyer

Investment Advisor

Broker-Dealer

Accredited investor criteria for individual:

Has a net worth higher than $1,000,000 either individually or with your spouse, not including your primary residence

Has an annual income higher than $200,000 for individuals

or $300,000 as joint income in the last 2 years and expect to earn more than that amount in this given year.

Is an investment professional in good standing, who holds the general securities representative license (Series 7), the investment adviser representative license (Series 65), or the private securities offerings representative license (Series 82)

Accredited investor criteria for an entity:

An entity owning investments in excess of $5 million

An entity where all equity owners are accredited investors

The following entities with assets in excess of $5 million:

Trusts

corporations

partnerships

LLCs

501(c)(3) organizations

employee benefit plans“family office” and any “family client” of that office

Investment advisers (SEC- or state-registered or exempt reporting advisers) and SEC-registered broker-dealers

Financial entities, such as:

a bank

savings and loan association

insurance company

registered investment company

business development company, or small business investment company, or rural business investment company

Can international investors participate?

Yes. We work with accredited investors worldwide.

Do investors get ownership in the properties?

Investors in our pre-seed Reg D offering get the privilege of owning a piece of everything Global Mogul owns, this includes all of our future properties.

How do I start investing?

Contact our investor relations team, complete our accredited investor verification, review and sign the subscription agreement, and fund your investment.

How long is my money invested?

We have a 1 year holding period for this offering. However, we are planning to launch our Reg CF round within 6-12 months. We are offering equity for the Reg CF round. Investors can sell then but we suggest typical terms are 24–48 months, to fully capitalize on our upcoming valuations. This is not investment advice. Contact your professional for all investment advice.

What is a SAFE?... and what is a SAFE round?

A SAFE, or Simple Agreement for Future Equity, is an investment contract used in early-stage financing rounds, particularly in startup fundraising. It's a relatively new instrument compared to traditional equity financing options like convertible notes or preferred stock.

A SAFE allows an investor to make a cash investment in a company with the expectation of receiving equity in the company at a later date, typically during a future priced equity round or upon a specific liquidity event, such as an acquisition or IPO. However, unlike a convertible note, a SAFE does not accrue interest or have a maturity date.

Key features of a SAFE:

Future Equity: The investor receives the right to obtain equity in the company at a future financing round or liquidity event, typically at a discount or with a valuation cap negotiated at the time of the SAFE agreement.

Simplicity: SAFEs are designed to be simpler and easier to understand compared to traditional equity financing documents, reducing legal complexity and negotiation time.

No Interest or Maturity Date: Unlike convertible notes, SAFEs do not accrue interest, nor do they have a maturity date by which the company must repay the investment if a qualifying event hasn't occurred.

Investor Protections: Depending on the terms negotiated, SAFEs may include investor-friendly provisions such as valuation caps, discount rates, and pro-rata rights in future financing rounds.

Lack of Voting Rights and Dividends: Typically, SAFEs do not grant investors voting rights or entitlement to dividends until the conversion event occurs.

Your VIP Pass To Global Real Estate Investing

Disclaimer

This website contains predictive or “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. All statements other than statements of current or historical fact contained in this website, including statements that express our intentions, plans, objectives, beliefs, expectations, strategies, predictions or any other statements relating to our future activities or other future events or conditions are forward-looking statements. The words “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “predict,” “project,” “will,” “should,” “would” and similar expressions are intended to identify forward-looking statements. These statements are based on current expectations, estimates and projections made by management about our business, our industry and other conditions affecting our financial condition, results of operations or business prospects. These statements are not guarantees of future performance and involve risks, uncertainties and assumptions that are difficult to predict. Therefore, actual outcomes and results may differ materially from what is expressed or forecasted in, or implied by, the forward-looking statements due to numerous risks and uncertainties. Factors that could cause such outcomes and results to differ include, but are not limited to, risks and uncertainties arising from: our ability to raise sufficient capital to execute our business plan; expectations for the clinical and pre-clinical development, manufacturing, regulatory approval, and commercialization of our pharmaceutical product candidate or any other products we may acquire or in-license; our use of clinical research centers and other contractors; expectations for incurring capital expenditures to expand our research and development and manufacturing capabilities; expectations for generating revenue or becoming profitable on a sustained basis; expectations or ability to enter into marketing and other partnership agreements; expectations or ability to enter into product acquisition and in-licensing transactions; expectations or ability to build our own commercial infrastructure to manufacture, market and sell our product candidates; acceptance of our products by doctors, patients or payors; our ability to compete against other companies and research institutions; our ability to secure adequate protection for our intellectual property; our ability to attract and retain key personnel; availability of reimbursement for our products; expected losses; and expectations for future capital requirements. Any forward-looking statements speak only as of the date on which they are made, and we undertake no obligation to publicly update or revise any forward-looking statements to reflect events or circumstances that may arise thereafter, except as required by applicable law. Investors should evaluate any statements made by us in light of these important factors.

Your VIP Pass To

Global Real Estate Investing

Disclaimer

This website contains predictive or “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. All statements other than statements of current or historical fact contained in this website, including statements that express our intentions, plans, objectives, beliefs, expectations, strategies, predictions or any other statements relating to our future activities or other future events or conditions are forward-looking statements. The words “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “predict,” “project,” “will,” “should,” “would” and similar expressions are intended to identify forward-looking statements. These statements are based on current expectations, estimates and projections made by management about our business, our industry and other conditions affecting our financial condition, results of operations or business prospects. These statements are not guarantees of future performance and involve risks, uncertainties and assumptions that are difficult to predict. Therefore, actual outcomes and results may differ materially from what is expressed or forecasted in, or implied by, the forward-looking statements due to numerous risks and uncertainties. Factors that could cause such outcomes and results to differ include, but are not limited to, risks and uncertainties arising from: our ability to raise sufficient capital to execute our business plan; expectations for the clinical and pre-clinical development, manufacturing, regulatory approval, and commercialization of our pharmaceutical product candidate or any other products we may acquire or in-license; our use of clinical research centers and other contractors; expectations for incurring capital expenditures to expand our research and development and manufacturing capabilities; expectations for generating revenue or becoming profitable on a sustained basis; expectations or ability to enter into marketing and other partnership agreements; expectations or ability to enter into product acquisition and in-licensing transactions; expectations or ability to build our own commercial infrastructure to manufacture, market and sell our product candidates; acceptance of our products by doctors, patients or payors; our ability to compete against other companies and research institutions; our ability to secure adequate protection for our intellectual property; our ability to attract and retain key personnel; availability of reimbursement for our products; expected losses; and expectations for future capital requirements. Any forward-looking statements speak only as of the date on which they are made, and we undertake no obligation to publicly update or revise any forward-looking statements to reflect events or circumstances that may arise thereafter, except as required by applicable law. Investors should evaluate any statements made by us in light of these important factors.